Cedomir Pusica

|

We live in an era of unprecedented growth, of gargantuan companies being created out of thin air, overnight. Or is it more along the lines of the famous quote by Chris Archer that “It takes ten years to become an overnight success”? Even if the latter is true, ten years is still nothing compared to the history of modern entrepreneurship. Let’s mention just some of the major giants who are now omnipresent, but were non-existent not so long ago: Apple, Microsoft, Google, Facebook, SpaceX, Tesla, Nike, Alibaba… Amazon. These are just a few big tech companies everyone immediately thinks of, and I am not forgetting all the others. For a full list of biggest companies in the world, just Google it. How did these companies become so big in so little time?I believe you have asked this question more than once. I have. And I studied a few of them. If I have to give you the reasons off the top of my head, the following combination of factors qualifies for the right answer (in order of importance):

So, how did Amazon do it?Brad Stone tells us the story in The Everything Store: Jeff Bezos and the Age of Amazon. Below are some of the major points in the history of Amazon, as told by Mr. Stone. It will give you enough information to make an informed opinion about the company, its CEO, and its practices. I do hope that you will learn how to appreciate what it does, however ruthlessly they might be doing it at times. I added some of my own comments, thoughts or otherwise shaped the story while massively drawing on the book for some of the exact phrases. The story of AmazonThe romanticized tale of garage startups couldn’t avoid Amazon, either. You are all familiar with that photo of Bezos sitting behind his work desk in mid-90s, with amazon.com written with spray on a piece of cardboard and riveted on the wall? Well, it’s all true. Fast forward to 2019, the company made it into Berkshire Hathaway Inc. portfolio – and if that’s not proof of its maturity, I don’t know what is. Amazon started modestly as an online bookseller, extended into selling music, movies, electronics and toys. Then in 2000-2001 it mastered the physics of its own complex distribution network and expanded into software, jewelry, clothes, apparel, sporting goods, automotive parts – you name it. Then it started selling cloud computing infrastructure known as Amazon Web Services, and devices like the Kindle and the Kindle Fire tablet. It spread into new markets and product categories all the while losing money. Why did Jeff Bezos decide to start with books?It is difficult to say what the future holds for Amazon and the world at large, since Bezos is someone who keeps his ideas to himself, but he decided in the beginning that if he couldn’t build a true everything store right away, he could capture its essence – UNLIMITED SELECTION – in at least one important product category. That category was books. “With that huge diversity of products you could build a store online that simply could not exist in any other way. A true superstore with exhaustive selection, and customers value selection.” Once he decided this was the right thing to do, Jeff took a 4-day course on bookselling. If this is not enough to drive the point home… He posed the question: How many books were in print worldwide? Three million. It was more than Barnes&Noble, the largest bookseller at the time, could ever stock. With his online bookstore, Bezos decided to create something superior to all the existing online bookstores. He invested in servers and hires (customer service, warehouse, technical team). He started building an editorial group – writers and editors who would craft a literary voice for the site. The mission was to make Amazon the most authoritative source of information about books. However, after some time, the engineers came up with an algorithm that provided customers with recommendations based on the books they bought – customers with similar purchase histories were grouped and shown the books they had not purchased. This meant that the writers and editors team was soon discontinued. Men lost the battle to the machines. For now. Getting the moneyBut… you may be wondering: that’s all nice and beautiful, but – how did he do any of that without money? Just like that? Well, no. Whoever lives outside the US generally has a hard time understanding how the American corporate world works and how much easier it is to get money for any idea that you want to develop in the US than anywhere else in the world. Not easy. Easier. There is also the widespread American corporate culture of providing stock options to employees (or requiring them to purchase stock options), thus ensuring their loyalty, and giving them a promise of larger gains in the future should the company’s stock price soar. Also, it often means that such employees would accept lower wages – again, lower not being low, rather below market average for the job. It is good for the company from the accounting perspective as well – although it is a perfect example of flawed reasoning and one of the reasons why companies reported profits should be taken with a grain of salt. Why? Let me borrow Charles Munger’s own words: “There was now an accounting convention in the United States that, provided employees were first given options, required that when easily marketable stock was issued to employees at a below-market price, the bargain element for the employees, although roughly equivalent to cash, could not count as compensation expense in determining a company’s reported profits.” One such employee was Shel Kaphan, the mother hen of all the tech systems, whose contract required him to commit to buying $5,000 of stock upon joining the company. Kaphan passed on the option of buying an additional $20,000 in shares later since he was already taking a 50% pay cut and would earn only $64,000 a year, like Bezos. Amazon.com was registered on November 1st, 1994. Bezos invested $10,000 and then over the next 16 months other $84,000 from interest-free loans. And there was also mom and dad, who put $100,000 in 1995. Jeff always thought about raising money; in summer 1995 he invested $145,000 from his mom’s family trust and continued hiring (he couldn’t make it on family’s savings alone). Nick Hanauer was pivotal in introducing Jeff Bezos to potential investors and helped to line up pitch meetings. He canvassed 60 potential investors, seeking to raise $1 million from individual contributors of $50,000 each. After raising $1 million, Amazon went public in 1997 (IPO). A few things about Jeff Bezos

Jeff studied several wealthy businessmen and particularly admired Frank Meeks, owner of Domino Pizza franchise. Bezos used the word ‘bold’ a lot. Also, before he opted for Amazon as the name for his company – the biggest river in the world, he wanted to call the company Relentless and he even bought the domain. There is something about that attribute that sticks with him and even today if you type Relentless.com it will take you to Amazon.com. He is unusually confident, more stubborn than anyone had thought, and he strangely and presumptuously assumes that people would work tirelessly and perform constant heroics. Bezos is a micromanager with a limitless spring of new ideas, and he reacts harshly to efforts that do not meet his rigorous standards. He is disciplined and precise, constantly recording ideas in a notebook he carries with him. However, he keeps his ambitions and plans to himself! Bezos believes that truth springs forth when ideas and perspective are banged against each other, sometimes violently. He is difficult to work with, like Steve Jobs, and is famous for his acerbic outbursts. Bezos, Jobs, Gates, Larry Ellison, Elon Musk lack a certain degree of empathy. That allows them to coldly allocate capital and manpower and make hyperrational business decisions while another executive might let emotion and personal relationships intrude. On the other hand, Bezos never gives you the sense that he is hurried or distracted – he is fully devoted. He uses one simple method to determine whether or not he should do something, the so called “regret minimization framework”: would you regret it when you are 80 years old? You may have heard about that proverb: “If you want to go fast, go alone. If you want to go far, go together.” It seems that Bezos is not in a hurry. Actually, he seems to be particularly good at the long game. One proof of it is that he always insisted on people ignoring the stock market valuations of Amazon. Those are just numbers. He wants to focus all his energy – and that of his employees – on creating value, becoming dominant, and practically – having a monopoly. As Peter Thiele explained in his book Zero to One, monopoly is a beautiful thing. By the way, does anyone have to tell you that? However, an important takeaway from that book is that companies that have a monopoly in a sector will claim to be just one of the many players and will do everything in their might to present their competitors, however tiny they may be, as monsters – otherwise, they may draw attention from the public and face the unfortunate destiny of Microsoft. The small fish, on the other hand will always claim to be “leaders” in the sector, and similar. Just look around, see who claims what and you will understand the world a bit better. Anyway, in the course of the years, Bezos surrounded himself with smart people who help him run the company. Some of the closest collaborators are organized in his S Team – which is his management council, and J Team, made up of his senior leadership ranks. If you ever want to contact Jeff Bezos, this is his email address: [email protected]. Tempted? “Jeff does a couple of things better than anyone I’ve worked for,” Rick Dalzell says. “He embraces the truth. A lot of people talk about the truth, but they don’t engage their decision-making around the best truth at the time.” “The second thing is that he is not tethered by conventional thinking. He is bound only by the laws of physics. He can’t change those. Everything else he views as open to discussion.” Bezos is a fan of e-mail newsletters such as VSL.com, a daily assortment of cultural tidbits from the Web, and CoolTools, a compendium of technology tips, and product reviews written by Kevin Kelly, a founding editor of Wired. Hiring at Amazon Hiring has been top priority from the very beginning. Bezos felt that hiring only the best and the brightest was key to success. He interviewed all potential hires and asked them for their SAT scores. New hires are given an industry-average base salary, a signing bonus spread over two years, and a grant of restricted stock units over four years. But unlike other tech companies, such as Google or Microsoft, which spend out their stock grants evenly, Amazon backloads the grant toward the end of the four-year period. Employees typically get 5% of their shares at the end of their first year, 15% their second year, and then 20% every 6 months over the final two years. Ensuing grants vest over two years and are also backloaded, to ensure that employees keep working hard and are never inclined to coast. Initial Amazon benefits:

Managers in departments of 50+ people are required to “top-grade” their subordinates along the curve and must dismiss the least effective performers. He personally runs biannual operating review periods, dubbed OP1 (done over the summer) and OP2 (done after the holiday season). Once a week (normally on Tuesday) various departments at Amazon meet with their managers to review the data. They then produce the weekly business review every Wednesday. Jeff hired mathematicians and scientists with PhD for finances. David Shaw, a friend of Bezos, helped him build the company. He decided to recruit other people – “generalists”, recent graduates at the tops of their classes who showed particular aptitude in particular subjects. They combed through the ranks of Fulbright scholars and dean’s-list students at the best colleges and sent hundreds of unsolicited letters introducing the firm and proclaiming: “We approach our recruiting in unapologetically elitist fashion.” By the way, Shaw became a billionaire by exploiting fractions of differences in stock prices in Europe and the US by way of math algorithms. The candidates had to meet the following criteria and go through the following selection process:

Microsoft hiring:

Amazon hiring:

As for the low-wage workers (paid $10-12/h), who work in fulfillment centers, there is a point system:

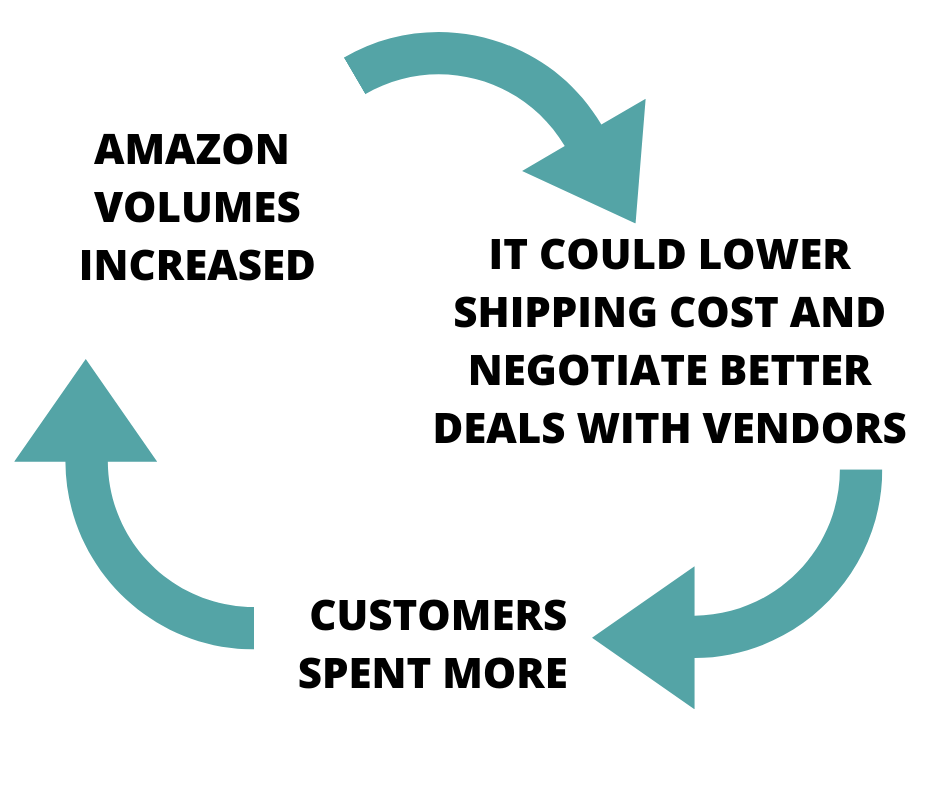

Moving forwardIn moving forward the only way to secure significant investment into the company was through venture capital. Jeff and Joy Covey (financial officer) traveled the US and Europe to pitch Amazon to potential investors. At the time, they had three years of data (1997). However, Jeff was secretive: he gave only the legal minimum of data and not a road map to use to follow in his footsteps. Kleiner Perkins Canfield and Byers invested $8 million and got 13% ownership stake (valuing it at $60 million). Jeff’s condition was that John Doerr was to sit on the Board of Directors. The influx of VC meant the influx of high-powered executives. After the IPO, the company needed a “deeper technical management”. Jeff sidelined Kaphan at that point… Similar to Elon Musk, he treated his employees like nothing more than employees – he did not get emotional about it. Amazon had only one true parent… ruthless about hiring and firing. Moving into Other Product CategoriesBezos wanted to generate the kind of returns that would allow him to invest in technology and stay ahead of rivals. This meant they had to spread into other categories. Bezos ordered his employees to research categories of products that had high SKUs (the number of potentially stockable items), were underrepresented in physical stores, and could easily be sent through the mail. He also asked everyone to write down a prediction of the company’s revenues in five years. To expand, they needed more capital; the company raised $326 million in a junk-bond offering (in May 1998) and the following February another $1.25 billion in what was at the time the largest convertible debt offering in history (4.75% interest rate – it was cheap capital at the time). They signed promissory notes for the convertible-bond deal. How do you measure the cost of capital? Bezos was stingy about giving stock, was frugal, preferred paying in cash. He insisted that all owners (including management) should fly coach and save on everything. He invested in: drugstore.com, pets.com, gear.com, wineshopper.com, greenlight.com, homegrocer.com, and the urban delivery service Kozmo.com. All these businesses went down in flames. Amazon had to focus on its own business – they could not deal with all these different businesses! Now, if Amazon could not deal with all those different businesses and all the money they had, why would anyone else focus on several businesses either? This is just a memo for myself. Kindle, Prime…At one point, Kindle Digital Text Platform (KDP) was introduced, a program that allowed authors to self-publish their works in the US Kindle store. It spread worldwide and guaranteed authors 70% royalty on their sales. Then, when the Amazon Sales Rank was introduced – where authors could see how well their books sold and monitor their standing – this was a drug to authors! Another important innovation came with the 1-click patent: it meant shorter time to purchase. All these little positive improvements resulted in the network effect: products and services become more valuable as more people use them. The engineers came up with the algorithm for matching the orders to correct fulfillment centers, and all this contributed to faster shipping (the algorithm calculated customer’s address, item ordered and its position in a FC, shipment cut-off times). An option was introduced for overnight, two-day, three-day delivery – extremely expensive both for Amazon and the client, but it paid dividends strategically. Price-conscious customers were given the super-saver shipping – orders placed on trucks whenever there was room for them. The Rise of PrimePrime ($79/year) was never about the money. It was about changing people’s mentality so they wouldn’t shop anywhere else. If each expedited shipping cost the company $8, a Prime member ordering 20 items a year would cost much more than the $79/year fee. They made the decision even though every single financial analysis said they were completely crazy to give two-day shipping for free. Effects:

Getting the House in OrderTo strengthen its cash position, Amazon sold $672 million in convertible bonds to investors overseas. They were forced to offer a far more generous 6.9% interest rate and flexible conversion terms. During these years of its awkward adolescence, Bezos refused to slow down, doubling and tripling his bet on the Internet and on his grand vision for a store that sold everything. However, at one point there was a shift from Get Big Fast to Get Our House in Order (discipline, efficiency, eliminating waste). Bezos brought in Jeff Wilke to fix the mess. Wilke graduated from Princeton, earned an MBA and an MS from the Massachusetts Institute of Technology’s engineering/MBA dual-degree program. It was Scott Pitasky who pitched Wilke on taking over the critical distribution network of Amazon. He told Wilke that he would have the chance to build a unique distributive network and define a nascent industry. Wilke filled the ranks of Amazon’s logistics division with scientists and engineers rather than retail distribution veterans. He wrote down a list of the ten smartest people he knew and hired them all. He combined Six Sigma with Toyota’s lean manufacturing philosophy, which requires a company to rationalize every expense in terms of the value it creates for customers and allows workers to pull a red cord and stop all production on the floor if they find a defect. Six Sigma – a manufacturing and management philosophy that seeks to increase efficiency by identifying and eliminating defects. One of the phrases that really stuck with me was Jeff Bezos’s reply to one of the engineers who complained about the teams not communicating enough: “Communication is a sign of dysfunction. Teams should communicate less with each other, not more." Even though I work in the communication business, I find the above statement absolutely crucial. And I interpret it not as an invitation to stop communicating with the world – on the contrary, but to automatize all recurrent tasks, introduce clear procedures and eliminate bottlenecks. Speaking of communication, you must have heard about the famous “narratives” that must be used instead of presentations in all new features or product launches? There is a six-page limit for narratives, with more room for footnotes. Every time a new feature or product was proposed, the narrative should take the shape of a mock press release. After 2000, all new hires had to directly improve the outcome of the company. He hired doers – engineers, developers, merchandise buyers, but not managers. His attitude was simple: Autonomous working units are good. Things to manage working units are bad. Lyn Blake created standards for how publishers shipped packages of books to Amazon’s FCs. She oversaw the creation of automated systems that purchased from whichever source – distributor or publisher – had books in stock and offered the best price. She introduced selling prominent placement on the side to publishers who were willing to pay promotional fees (a tactic others had employed and which worked well). This traditional retailing concept (earning cooperative marketing dollars, or co-op, from suppliers in exchange for highlighting their products to customers) extended to other items as well. Becoming a platformIt is the ambition of every technology company to offer a set of tools that other companies can use to reach their customers. It wants to become – a platform. When Amazon decided to sell toys, Jeff wanted Toys “R” Us to put every available toy on the site. Toys “R” Us argued it was too expensive and impractical and wanted to be the exclusive seller of toys on Amazon, but Jeff thought it was too constricting. They agreed, after months of negotiations, that Toys “R” Us would sell a few hundred most popular toys through Amazon, and Amazon reserved the right to complement the Toys “R” Us selection with less popular items. It was decided that Toys “R” Us inventory was to be kept in Amazon’s distribution centers, and so this model became the business platform for other companies to use. FBA – Fulfillment by Amazon was born. Now you can use this service to store and have your products shipped from Amazon FCs. Phoenix 3 fulfillment center is 605,000 square feet. Every product, shelving unit, forklift, roller cart, and employee badge has a bar code, and invisible algorithms calculate the most efficient paths for workers through the facility. Amazon was now enjoying operating leverage – it was getting more out of its assets. In 2007 Amazon quarterly sales topped $3 billion for the first time – a 32% jump in a year, well above its previously consistent 20-something percent annual growth rate and the 12% annual growth rate for the rest of e-commerce. For most normal people, this would be more than they could ever dream of achieving, but Bezos is not a normal person. “In order to be a $200 billion company, we’ve got to learn how to sell clothes and food.” And that is exactly what they are doing. Amazon – A Tech Company Amazon’s vision: a company with data at its heart. To help turn that vision into reality was Kal Raman, the former Drugstore.com executive whose groups developed automated tools that allowed buyers to order merchandise based on dozens of variables such as seasonal trends, past purchasing behaviors, and how many customers were searching for a particular product at certain times. Raman’s teams improved the software for pricing bots, automated programs that crawled the web, spied on competition and adjusted Amazon’s pricing. Bezos became enamored with a book called Creation, by Steve Grand, the developer of a 1990s video game called Creatures that allowed players to guide and nurture a seemingly intelligent organism on their computer screens. He designed simple computational blocks, called primitives, and then sat back and watched surprising behaviors emerge. Bezos directed a group of engineers in brainstorming possible primitives. Storage, bandwidth, messaging, payments, and processing all made the list. For all those who have read The Selfish Gene, by Richard Dawkins, this idea of ‘primitives’ seems very much like professor Dawkins’ theory of the genes’ evolution, and it is a fascinating one. So, if you have not read this book, I recommend that you do. Pinkham, one of the engineers who worked at Amazon, and his team opened an Amazon office in Cape Town and developed the Elastic Compute Cloud, or EC2 – the service that is at the heart of AWS and that became the engine of the Web 2.0 boom. Mission statement of AWS: “to enable developers and companies to use Web services to build sophisticated and scalable operations.” AWS’s success had to do with its business model – you pay what you use, just like using the electric grid. Bezos priced AWS services so low (10c/h instead of 15c that would allow the company to break-even) in order not to repeat Steve Jobs’ mistake of pricing the iPhone in a way that was so fantastically profitable that the smartphone market became a magnet for competition. Microsoft announced a similar cloud initiative called Azure in 2010. In 2012, Google announced its own Compute Engine. Fighting the Big GuysIn the 1990s, companies like Best Buy, Walmart, Costco ushered in a new age of self-service shopping and big-box stores. This drew Circuit City, once the largest retailer in the country, to bankruptcy. Many companies failed because they had a narrow operating philosophy and repeatedly missed the changing tastes of consumers. Target came to the realization that it did not have the in-house capabilities to build its own website and it outsourced its online operations to Amazon, a mistake that Walmart did not make. Walmart made its internet operation in Brisbane, north of Silicon Valley. Price war between Walmart and Amazon ensued, involving Target as well. Amazon wielded its market power neither lightly nor gracefully, employing every bit of leverage to improve its own margins and pass along savings to its customers. Have you ever wondered how come Amazon could ship almost any title so fast anywhere in the world? The answer is CreateSpace – on-demand publishing unit that could print a physical book when a customer ordered it on Amazon.com. Publishing executives at one point decided to use their leverage (fact that they were printing 60% of the books sold on Amazon.com) but the effort made its way to court. Apple entered the competition and before launching iPad, Jobs wanted every kind of media available – including books. In the new e-book model, publishers themselves would officially become the retailers and could set their own prices, typically in the more comfortable zone (for them) of between 13 and 15 dollars. Apple would act as a broker and receive a 30% commission, the same arrangement it had for mobile applications on the iPhone. As part of this shift to what was known as the agency model, Apple received a guarantee that other retailers would not undercut it on e-books prices. E-booksMartin Eberhard (co-founder of Tesla) and Marc Tarpenning developed one of the first portable e-readers – Rocketbook. They went to Bezos and negotiated his investing in the company. After 3 weeks, Bezos said he was concerned that by backing Nuvo Media he might be creating an opportunity for Barnes & Noble to swoop in and buy the startup, so he demanded exclusivity provisions in any contract between the companies and wanted veto power over future investors. The deal did not go through and Eberhard and Tarpenning flew to New York to talk to Barnes & Noble and reached a deal within a week. The publishing giant Bertelsmann decided to invest $2 million, plus as much from Barnes & Noble, owning together nearly half of Nuvo Media. Eberhard sold Nuvo Media in 2000 to Gemstar for $187 million in a stock transaction. Since innovation is one of Amazon’s core values, Bezos set out on a mission to develop his own electronic reading device. As late Harvard professor Clayton Christensen wrote in The Innovator’s Dilemma: “Great companies fail not because they want to avoid disruptive change but because they are reluctant to embrace promising new markets that might undermine their traditional businesses and that do not appear to satisfy their short-term growth requirements.” The companies that solved the innovator’s dilemma succeeded when they “set up autonomous organizations charged with building new and independent businesses around the disruptive technology.” Kessel was put in charge of “killing his own business” and developing an electronic reading device. He didn’t know anything about hardware so he went to meet Apple and Palm hardware experts and executives from the famed industrial design firm Ideo. The Pentagram designers (a nimbler firm, smaller than Ideo) worked on the Kindle for nearly two years. It was not an easy task, and there never lacked people who would say it was impossible, too difficult, or that it should be done otherwise. Bezos had a vision and would not let anyone interfere with it. One of his anthological responses was: “Look, we already talked about this. I might be wrong, but at the same time I’ve got a bit more to stand on than you have.” To succeed with the Kindle, Amazon needed a huge library of downloadable e-books. It had to pressure, cajole, and even threaten some of its oldest partners. When they approached publishers to ask them to digitalize their books, they never talked about the price they would be selling those books at. What is Amazon generally criticized for?Amazon was criticized for:

To conclude, Amazon is the “Unstore”, not bound by the traditional rules of retail. They are thinking outside the box. They do not think rules are carved in stone and they do dare break them. They are not doing it elegantly, they do irritate a few people on the way, but so far, they have always managed to change the rules of the game to their advantage – and to the advantage of their customers, who really are at the center of their efforts. Love Amazon. Before you go, check out the two resources below. List of books recommended by Jeff Bezos or otherwise mentioned in the bookThe Remains of the Day, by Kazuo Ishiguro Sam Walton: Made in America, by Sam Walton with John Huey Memos from the Chairman, by Alan Greenberg The Mystical Man-Month, by Frederick P. Brooks Jr. Built to Last: Successful Habits of Visionary Companies, by Jim Collins and Jerry I. Porras Creation: Life and How to Make It, by Steve Grand The Innovator’s Dilemma: The Revolutionary Book That Will Change the Way You Do Business, by Clayton M. Christensen Good to Great: Why Some Companies Make the Leap... and Others Don't, by Jim Collins (one of Bezos’s favorite books) The Goal: A Process of Ongoing Improvement, by Eliyahu M. Goldratt and Jeff Cox Lean Thinking: Banish Waste and Create Wealth in Your Corporation, by James P. Womack and Daniel T. Jones Data-Driven Marketing: The 15 Metrics Everyone in Marketing Should Know, by Mark Jeffery The Monk and the Riddle, by Randy Komisar The Black Swan: The Impact of the Highly Improbable, by Nassim Nicholas Taleb From his choice of books the following pattern emerges: experiment a lot, risk, understand your processes, the strengths and the weaknesses, strengthen the strengths and eliminate the weaknesses, improve constantly, be lean, frugal, and rely on data. Efficiency. Small teams, small building blocks. List of VC firms and private equity funds (mentioned in the book)

Learn from Amazon

2 Comments

Colin Kleyweg is an Australian who lives between Serbia and Australia and who speaks quite fluent Serbian - which shocked me the first time we met. And we met thanks to LinkedIn. With his wife Marina Kleyweg and other family members and friends, they have successfully built land development operations and now, they are building a strong rugby presence in Serbia through Red Star Belgrade Rugby Club, matched with a solid media and marketing business that is yet to yield truly significant results. Colin was kind enough to ask me for an interview, published originally on the club's Facebook page, and I am now simply reposting it here for you to enjoy, hopefully. Colin: To train in a sport like martial arts obviously takes great preparation, both mental and physical. Do you have any advice for young sportsmen relating to your preparation and how hard you work? Cedomir: Whatever it is you decide to do in your life at a professional level, or with the aim of arriving at a professional level, must be deeply ingrained in your daily routine. You must shape your life around that one objective. It is tough. Everything at top level is tough, but the rewards are amazing. The path is sometimes difficult, but it’s not just sweat and pain – you must love what you do, otherwise, it makes no sense. Even if you love it, sometimes it is tough to drag yourself to the gym or go run in the open. I learned that these are the best times to do it, when you feel least motivated. It builds your spirit, your mindset, your iron will, and that is where victory resides! Even in martial arts, where it is about physicality and technique, and stamina – it is the mind that plays the crucial role. So, train hard and smart, listen to your body and your mind, but don’t cede to the temptation your mind will certainly present you with – of doing it the next time, tomorrow, and similar. Be resolute, hardworking, patient, consistent. Colin: As a young Serbian you moved to Italy. How do you find the challenge of living abroad in a different culture and with a different language? Cedomir: It would not be the first time I moved to a different country. I lived, worked, or studied in the US, Spain, and Greece. I started from zero so often that I find it too natural. As for Italy, the country shares many of the values I am used to back at home, so it was not a huge shock. However, it did take me about a year to get used to the Italian ways. As for the language, I am a linguist, so it was not a major obstacle to me. I already spoke decent Italian thanks to my wife, and moving to Italy helped me become fluent in what many define the most beautiful language in the world. It was not always a smooth ride, but nothing was really an obstacle. Colin: Not only have you succeeded in a tough, uncompromising sport, but you also have developed a leadership business. What are the similarities for you in achievement in sport and in business? Cedomir: They are entwined. One influences the other, but it is the leadership habits that have done it for me. You must be willing to put in the hard work, do it consistently and be persistent about it. Sports give you the mental strength and they truly shape your spirit. Mens sana in corpore sano. A healthy mind in a healthy body. It is not just some meaningless phrase. It is the absolute truth. If you don’t take care of your body, your mind will become sluggish. Always learning and feeding your brain with important works of business authors, philosophers, as well as novels is a recipe to success. Before you set out to make a successful business, you must decide what your objective truly is, what success means to you and what it translates to in financial terms. Only then does it make sense to plan your steps, your years and your days. I take business personally, so I needed to figure out who I am. I analyse myself a lot, and only at this stage in my life – I am forty now, do I realize what that Delphic maxim “Know thyself” was all about! Best way to do it is analysing yourself in extreme situations – when you fight, when you are hungry, when you are angry, happy, proud, etc. Once I understood who I am and what I stand for, I applied it methodically to my business, so the three pillars that define me and my business are: truth, honesty and integrity. They mean responsibility and accountability, being fair and delivering on one’s promises, and holding oneself to high moral and ethical standards. They are the basis for cooperation with other people, for building and keeping meaningful and trustworthy relationships that enable everyone to grow and prosper. Colin: Your first experience in rugby League was watching an international. What are the things you loved about this new game and do you see the sport as having a Serbian future? Cedomir: Wow! That was an awesome experience. First, thank you for inviting me to see the match. It was an absolute feast for me. One thing that struck me in particular was how manly the sport is. It takes a lot of muscle strength and agility, plus tons of teamwork to make it work. There is everything – from strategy to execution, and let’s not forget the mind, because when the resolution falters, you can see it in the field. The funny thing is that rugby has not been more present in Serbia until now. When I was a kid, and that was mid-eighties, I remember we used to play rugby in school. It was a small Serbian village in the south-west, but we played rugby, football (soccer), volleyball (that is not something you see often even in bigger towns) and basketball. But yes, rugby was there. Then, it was no more. That is strange. Serbs being Serbs, very strong in constitution and competitive, I envisage a bright future for the sport in Serbia. What is needed is to create awareness. Once you see the match, you will love it. And I believe it is so much better seeing it at the stadium. It is where you start to appreciate what is going on in the field. You feel the energy. Colin: What does the future hold for you? Can you share with us your sporting and business goals? Cedomir: I have grown to know that future is a promise, not a certainty, so whatever it holds for me, it’d better wait. Gods laugh at our plans, but we plan anyway. Sometimes it feels like a fool’s business, but the imaginary goals we give ourselves certainly work their magic and make us active and productive. On June 2nd 2019 I became the Italian kickboxing champion in my category (seniors, under 85 kg), so I can tick off one of my sporting goals from the list. After three rounds of qualifications that started in January and the finals in Rimini, Italy, I did it! It was a big one for me, especially because I won the mind game. Now, I want to continue training and I see myself training as long as I live. At one point, my goal is to open my martial arts school and start teaching, too. Now, speaking of teaching, one other thing that I love doing is teaching, but not in the sense of teaching in schools, day in, day out, but rather in the sense of coaching. It would be good to combine the passion with other people’s needs so that everyone would profit from it. Teacher learns the most. And I love learning and spreading the knowledge.

Back to sports, with a couple of friends we set up a Jeet Kune Do and Combat Sports Federation in Italy (Federazione Jeet Kune Do e Sport da Combattimento), of which I am vice-president, so one of the goals is to promote it and get as many clubs involved as possible, organize tournaments, instructor certification programs, etc. As for business, I want to be the one uniting nations not only by facilitating communication – through translation and interpreting, but also through commerce. I am learning about export management, internationalization, negotiating and other related subjects, while at the same time seeking to actively promote Serbian products in Italy and Italian products in Serbia and abroad. I see myself as part of a group of persons, who collaborate effectively and whose skills are compatible with the common goal of facilitating communication and the flow of goods between people. Collaboration is the key word. One man can do only as much. Together, though, people can move mountains. |

AuthorI've been writing ever since I was a child, my first collection of poems written at the age of 7-8 (an entire notebook that is somewhere in the attic - I will have to find it!) ArchivesCategories |

RSS Feed

RSS Feed